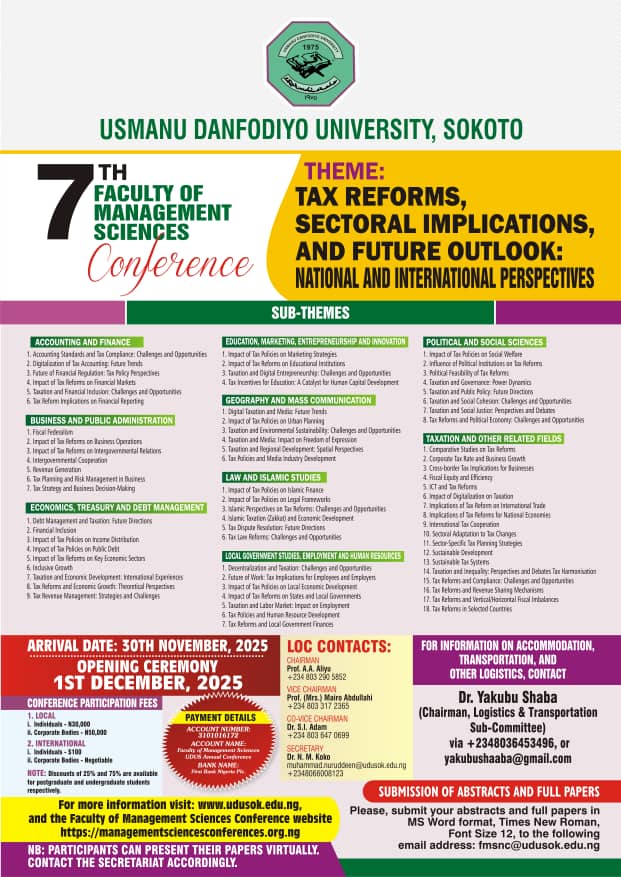

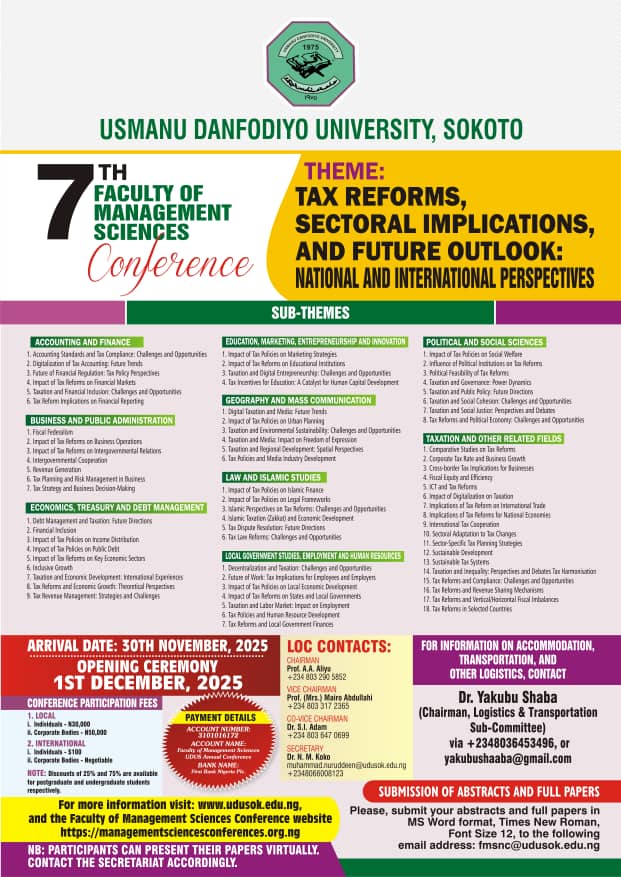

Submission of Abstract and Full Paper

Please submit your abstract and full paper in:

- MS Word Format

- Times New Roman

- Font Size: 12pt

Days

Hours

Minutes

Seconds

Please submit your abstract and full paper in:

These are theme and sub-themes of the conference

| 1 | 6th Faculty of Management Sciences Conference |

Discout of 25% and 75% are availale for postgradute and undergraduate students respectively

Faculty of Management Sciences

Usmanu Danffodiyo University

Sokoto

https://managementsciencesconferences.org.ng